- What Is BOI Reporting and Why It Matters for CPAs

- Key Features to Look for in BOI Reporting Software

- Top 5 BOI Reporting Software Solutions for Accounting Firms (2025)

- How to Implement BOI Reporting as a Service in Your Firm

- Common BOI Reporting Mistakes (And How to Avoid Them)

- FAQs: BOI Reporting for Accounting Professionals

- My Opinion: Why BOI Compliance Is a Strategic Opportunity—Not Just a Burden

Starting January 1, 2024, the U.S. Corporate Transparency Act (CTA) went into full effect—requiring millions of small businesses and entities to report their Beneficial Ownership Information (BOI) to the Financial Crimes Enforcement Network (FinCEN). For accounting firms, this isn’t just another compliance checkbox—it’s a new operational reality.

With tight deadlines, evolving guidance, and stiff penalties for non-compliance (up to $500 per day!), firms need reliable, efficient BOI reporting software that integrates seamlessly into their workflows. But not all tools are created equal. In this guide, we’ll explore the top BOI reporting platforms built specifically for accounting professionals, what to look for, and how to choose the right solution for your practice in 2025

What Is BOI Reporting and Why It Matters for CPAs

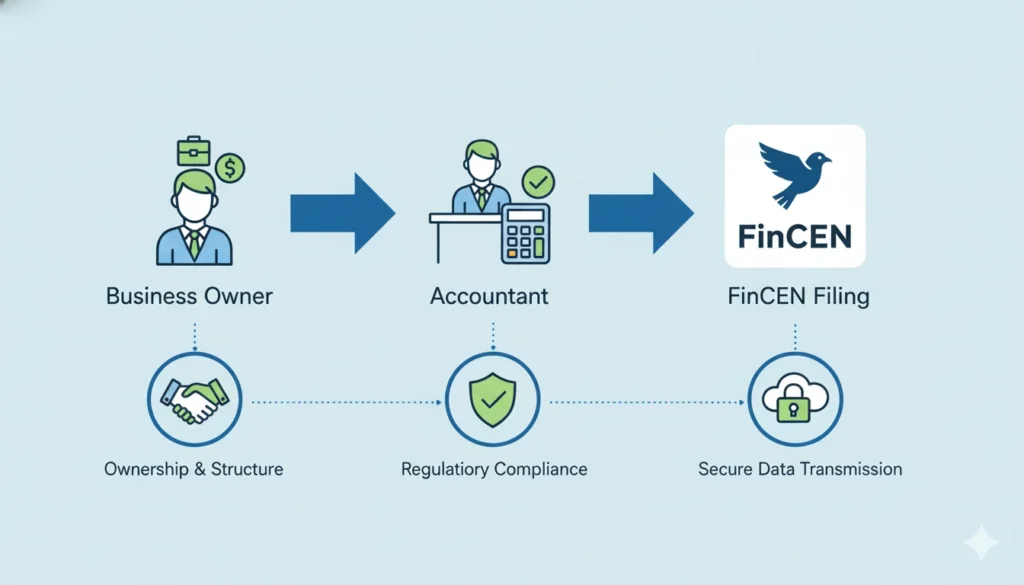

Beneficial Ownership Information (BOI) reporting is a federal requirement under the Corporate Transparency Act aimed at increasing transparency and combating money laundering, tax fraud, and other illicit financial activities.

Essentially, most U.S. companies formed or registered before 2024 must disclose who ultimately owns or controls them—typically individuals holding 25% or more ownership or significant managerial control.

For accounting firms, this means clients are turning to you for guidance. Even if you don’t file BOIRs yourself, you’re often the first point of contact for confused business owners. Offering BOI compliance as a service—or at least directing clients to a trusted tool—builds trust and adds value.

Key Features to Look for in BOI Reporting Software

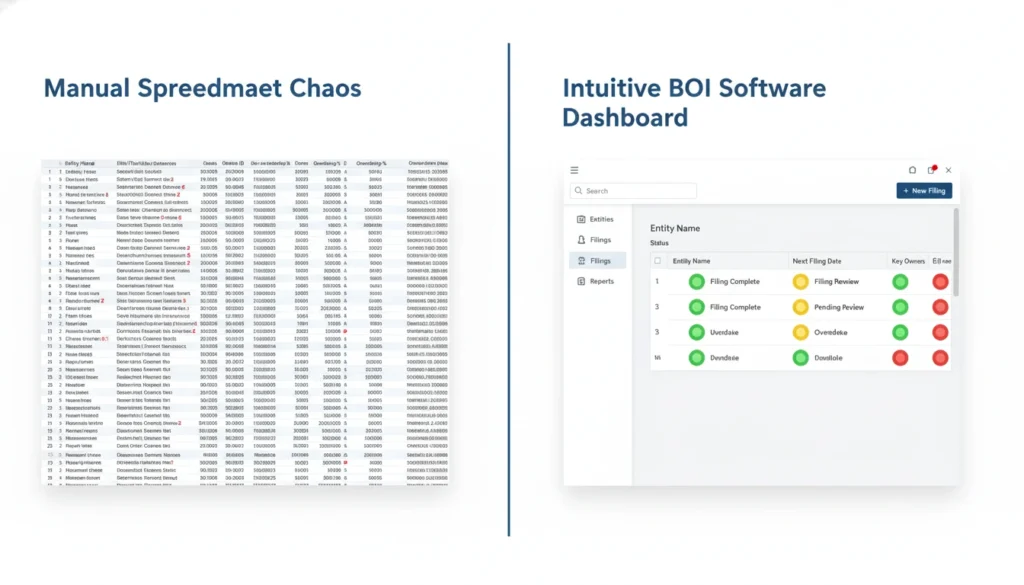

Not every “compliance tool” is equipped for the nuances of BOI. When evaluating BOI reporting software, prioritize these features:

- Automated Data Collection: Client-friendly intake forms that auto-populate FinCEN fields.

- Secure Document Storage: End-to-end encryption for sensitive ownership details.

- Bulk Filing Capabilities: Essential for firms managing dozens or hundreds of entities.

- Audit Trail & Version Control: Track changes and submissions for liability protection.

- CPA-Focused Dashboard: Clear status indicators (e.g., “Filed,” “Pending,” “Exempt”).

- Integration with Practice Management Tools: Sync with QuickBooks, Canopy, or Karbon.

Avoid generic form builders—they lack the regulatory precision and compliance safeguards needed for BOIR submissions.

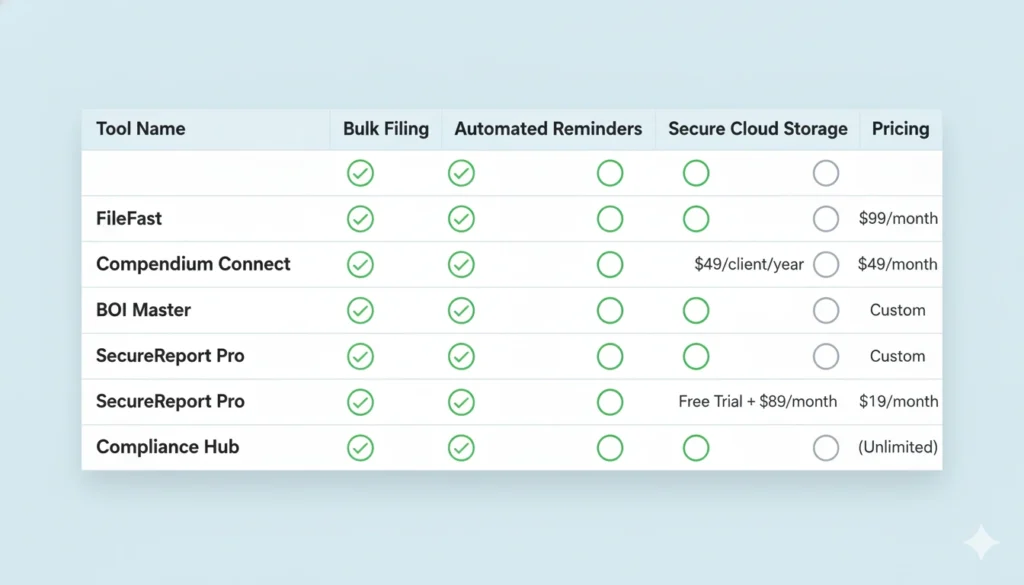

Top 5 BOI Reporting Software Solutions for Accounting Firms (2025)

1. BOI Manager Pro

Built by former FinCEN advisors, this platform offers CPA-specific workflows, real-time validation, and IRS-aligned data handling. Pricing starts at $99/month for up to 50 filings.

2. ComplyRight BOI Suite

Known for its seamless integration with tax software, ComplyRight includes exemption checkers and client e-signature support. Ideal for mid-sized firms.

3. TrueBOI

A lean, affordable option ($49/month) with a simple interface—great for solo practitioners or small firms just starting with BOI services.

4. EntityKeeper

Offers advanced features like recurring compliance alerts and cross-state entity tracking. Best for firms managing complex multi-state portfolios.

5. FinCEN FileDirect (by Thomson Reuters)

Enterprise-grade security and audit capabilities. Pricier but trusted by large CPA networks and RIA firms.

All these platforms allow you to file BOIR online directly through FinCEN’s API or secure portals, reducing manual errors.

How to Implement BOI Reporting as a Service in Your Firm

Adding BOI compliance to your service menu doesn’t require overhauling your practice. Start with these steps:

- Educate Your Team: Host a 30-minute training on CTA basics and filing deadlines.

- Choose One Platform: Pilot a single BOI software for consistency.

- Create a Client Package: Bundle BOI filing with entity formation or annual compliance reviews.

- Communicate Proactively: Email templates can alert clients about upcoming deadlines.

- Track & Report: Use your software’s dashboard to show clients their compliance status.

Many firms charge $150–$300 per filing—turning a regulatory burden into a profitable niche service.

Common BOI Reporting Mistakes (And How to Avoid Them)

Even experienced CPAs can stumble on BOI filings. Watch out for:

- Missing Exemptions: Certain entities (e.g., banks, nonprofits, large operating companies) are exempt—but you must verify eligibility.

- Incorrect Identifiers: Using an EIN instead of an individual’s SSN or passport number where required.

- Late Submissions: Initial reports for pre-2024 entities were due by January 1, 2025; new entities have 30 days post-formation.

- Poor Recordkeeping: FinCEN may request proof of filing—store confirmation receipts securely.

Using purpose-built beneficial ownership information software drastically reduces these risks through built-in validation and guidance.

FAQs: BOI Reporting for Accounting Professionals

Q: What is corporate transparency act software?

A: It’s specialized compliance software designed to help businesses and their advisors collect, validate, and submit BOI data to FinCEN in accordance with the CTA.

Q: How much does BOI software cost for CPAs?

A: Pricing ranges from $49/month for basic plans to $300+/month for enterprise solutions with bulk filing and team access. Many offer per-filing pricing too.

Q: Can I file BOIR online without software?

A: Yes—FinCEN offers a free web portal—but it’s manual, time-consuming, and lacks audit trails. Software streamlines the process and reduces errors.

Q: Is BOI software secure enough for sensitive client data?

A: Reputable platforms use bank-level encryption, SOC 2 compliance, and strict access controls. Always verify a vendor’s security certifications.

Q: What’s the best beneficial ownership reporting tool for small firms?

A: TrueBOI and BOI Manager Pro offer the best balance of affordability, ease of use, and CPA-focused features for small to mid-sized practices.

My Opinion: Why BOI Compliance Is a Strategic Opportunity—Not Just a Burden

As a former compliance consultant turned content strategist, I’ve watched countless accounting firms treat BOI reporting as a headache. But here’s the truth: this is one of the biggest value-add opportunities in years.

Clients are anxious, confused, and looking for trusted advisors. By offering a streamlined, tech-enabled BOI filing service, you position your firm as proactive, tech-savvy, and indispensable. Plus, the margins are strong—most filings take under 15 minutes with the right software.

Don’t wait for clients to ask. Lead with education, bundle BOI into your onboarding for new entities, and use it as a gateway to deeper advisory relationships. In 2025 and beyond, compliance isn’t just about avoiding penalties—it’s about building trust in an increasingly transparent business world.

Ready to simplify BOI compliance?

Explore our [Top 5 BOI Software Comparison Guide] (internal link idea) or [Download Our BOI Client Checklist Template] (internal link idea).

Call to Action:

If you’re an accounting firm evaluating BOI tools, start with a free trial of BOI Manager Pro or TrueBOI—we’ve vetted both for security, ease of use, and CPA-friendly design. Your clients (and your bottom line) will thank you.