Breaking into a new market is exhilarating—but also risky. Without the right metrics, even the most promising expansion can fizzle out before it gains traction. That’s where new territory penetration KPIs come in. For business development managers (BDMs), these performance indicators aren’t just numbers—they’re your compass in uncharted waters.

Whether you’re entering a new geographic region, targeting a fresh industry vertical, or launching to a different customer segment, tracking the right KPIs ensures you’re not just spending resources—you’re building sustainable growth.

In this guide, we’ll walk through the five essential KPIs that every BDM must monitor when executing a new territory strategy. You’ll learn how to measure progress, spot red flags early, and pivot with confidence—all while aligning with broader revenue goals.

1. Market Share Growth Rate in New Territory

One of the clearest signs your new territory strategy is working? Growing market share. This KPI measures the percentage of total addressable market (TAM) you’ve captured over time.

Calculate it as:

(Your Sales in New Territory ÷ Total Market Sales) × 100

A steady upward trend indicates strong brand acceptance and competitive positioning. If growth stalls, it may signal issues with messaging, pricing, or local competition.

Track this monthly during the first 6–12 months. Pair it with win/loss analysis to understand why you’re gaining (or losing) ground.

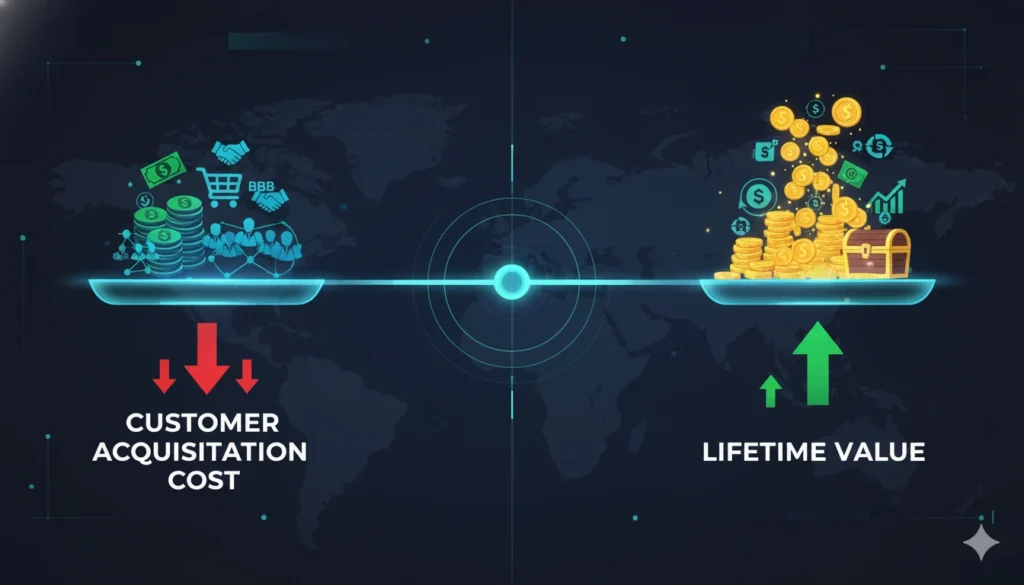

2. Customer Acquisition Cost (CAC) vs. Lifetime Value (LTV)

In new territories, CAC often spikes due to unfamiliarity, higher marketing spend, and longer sales cycles. But if your LTV:CAC ratio stays healthy (ideally 3:1 or higher), you’re on solid ground.

Monitor CAC by channel—digital ads, field sales, partnerships—to identify the most efficient paths to conversion. Simultaneously, track early LTV signals like repeat purchases, upsell rates, or contract renewals.

If CAC remains high while LTV lags, consider refining your ICP (Ideal Customer Profile) or adjusting your go-to-market motion.

3. Sales Cycle Length in New Markets

A prolonged sales cycle can drain resources and delay ROI. In established markets, your team might close deals in 45 days—but in a new territory, it could stretch to 90+ days due to trust-building, education, or regulatory hurdles.

Track average sales cycle length from first touch to closed-won. Compare it against benchmarks from mature regions. If it’s significantly longer, investigate bottlenecks: Is your demo too generic? Are decision-makers harder to reach?

Shortening this cycle—even by 10–15 days—can dramatically improve cash flow and rep productivity.

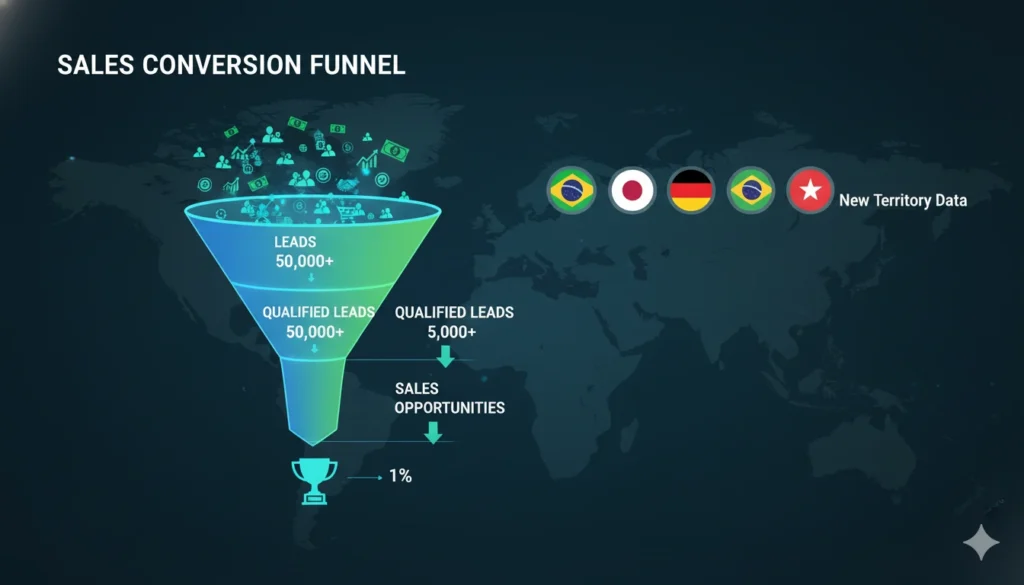

4. Lead-to-Opportunity Conversion Rate

Not all leads are created equal—especially in unfamiliar markets. Your lead-to-opportunity conversion rate reveals how well your targeting and messaging resonate with the new audience.

A low rate may mean your lead sources are misaligned (e.g., targeting the wrong job titles) or your value proposition isn’t localized. Aim for consistency with your core markets; if it’s 20% there, 15–18% in a new territory is acceptable early on.

Use this KPI to refine lead scoring models and sales enablement content.

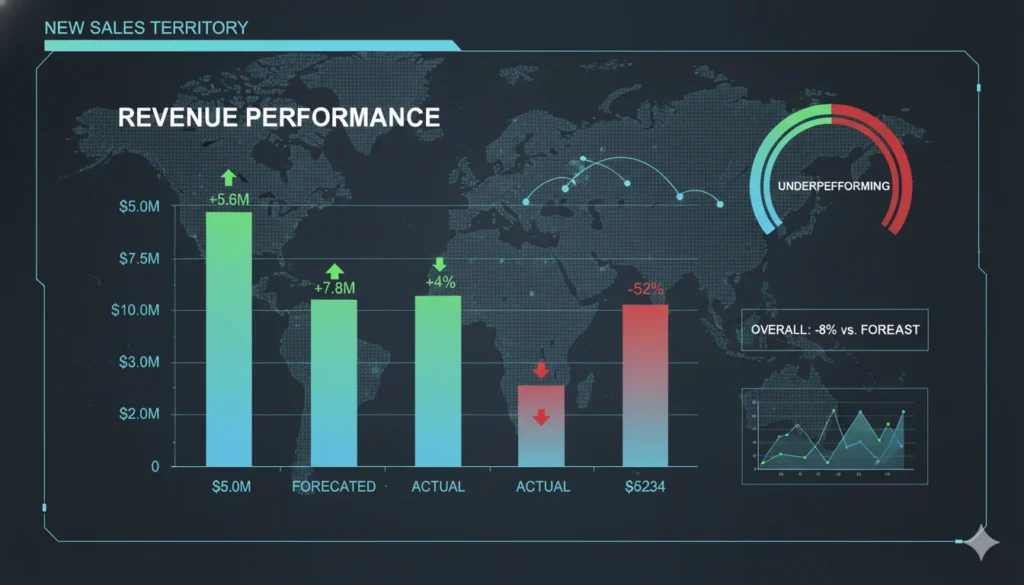

5. Territory Revenue Attainment vs. Forecast

Ultimately, revenue attainment tells you whether your new territory is delivering on promises. Compare actual monthly/quarterly revenue against your forecasted targets.

Consistently missing targets by >20% warrants a strategic review: Is the TAM smaller than estimated? Are competitors more entrenched? Are your reps properly trained on local nuances?

Use rolling forecasts—updated every 30 days—to stay agile and adjust quotas or resource allocation as needed.

FAQs:

Q: What is new territory penetration in sales?

A: It’s the strategic process of entering and gaining traction in a previously untapped market—geographic, demographic, or industry-based—measured by adoption, revenue, and market share.

Q: How do you measure success in a new market?

A: Through KPIs like market share growth, CAC:LTV ratio, sales cycle length, conversion rates, and revenue attainment against forecast.

Q: What KPIs indicate strong market adoption?

A: Rising market share, high lead-to-opportunity conversion, and consistent revenue growth with shortening sales cycles.

Q: Why is customer acquisition cost important in new territories?

A: CAC often spikes during market entry; monitoring it ensures you’re not overspending to acquire customers who don’t deliver long-term value.

Q: How long does it take to see ROI in a new market?

A: Typically 6–18 months, depending on industry complexity, sales model (self-serve vs. enterprise), and competitive landscape.

💡 My Opinion: The Human Side of Territory Expansion

After a decade in B2B growth strategy, I’ve seen brilliant market entries fail—not from bad data, but from ignoring the human element. KPIs are essential, yes, but they’re only as good as the team interpreting them.

New territory penetration isn’t just about hitting numbers; it’s about listening. Local partners, early customers, and frontline reps hold insights no dashboard can show. Are cultural nuances affecting buying behavior? Is a competitor offering bundled services you hadn’t considered?

The best BDMs blend data with empathy. They treat KPIs as conversation starters—not verdicts. If your CAC is high, don’t just cut ad spend—ask why the message isn’t sticking. If sales cycles drag, don’t blame reps—co-create solutions with them.

In 2025, AI and automation will give us richer data than ever. But the winners will be those who use that data to connect, not just convert.