- The Shift: From Speculation to Institutional Infrastructure

- Why Businesses Are Integrating Crypto Now

- Navigating Regulation, Risk, and Compliance

- Actionable Guide: Implementing a Crypto Strategy

- Expert Opinion: Closing the “Utility Gap”

- FAQ: Common Business Crypto Questions

- Conclusion: Future-Proofing Your Business

There was a time—not so long ago—when mentioning “cryptocurrency” in a boardroom triggered skeptical eye-rolls or urgent calls to security. It was dismissed as the playground of cyberpunks and gamblers: a lawless “Wild West” with no place in serious corporate strategy.

If you still hold that view today, here’s the uncomfortable truth: you’re already behind the curve.

The narrative has shifted decisively. With the approval of Bitcoin ETFs and the entry of financial giants like BlackRock, Fidelity, and Goldman Sachs, cryptocurrency has evolved from a speculative fringe into a core component of modern financial infrastructure for cryptopronetwork business.

We’re no longer debating if crypto belongs in business—we’re determining how deeply and how quickly to integrate it.

For business leaders, adopting a cryptopronetwork business isn’t about chasing moonshots. It’s about efficiency, treasury diversification, and leveraging blockchain technology to streamline operations, reduce costs, and unlock new revenue models.

In this guide, we cut through the noise to explore what the digital asset revolution actually means for your enterprise, your balance sheet, and your strategic future for cryptopronetwork business.

The Shift: From Speculation to Institutional Infrastructure

The most transformative development in recent years is the migration of crypto from retail speculation to institutional adoption.

When companies like MicroStrategy, Tesla, and Marathon Digital began adding Bitcoin to their balance sheets, they signaled a fundamental reframing: Bitcoin is digital gold—a store of value in an era of monetary uncertainty.

Bitcoin as Corporate Property

In many jurisdictions, digital assets are now legally recognized as personal property. This means businesses can:

- Hold crypto on their balance sheets

- Insure it like physical assets

- Use it as collateral for loans

- Include it in estate and succession planning

This legal clarity has enabled enterprise-grade digital asset management—a far cry from the early days of “be your own bank.”

The ethos is maturing: from DIY crypto wallets to upgraded financial infrastructure.

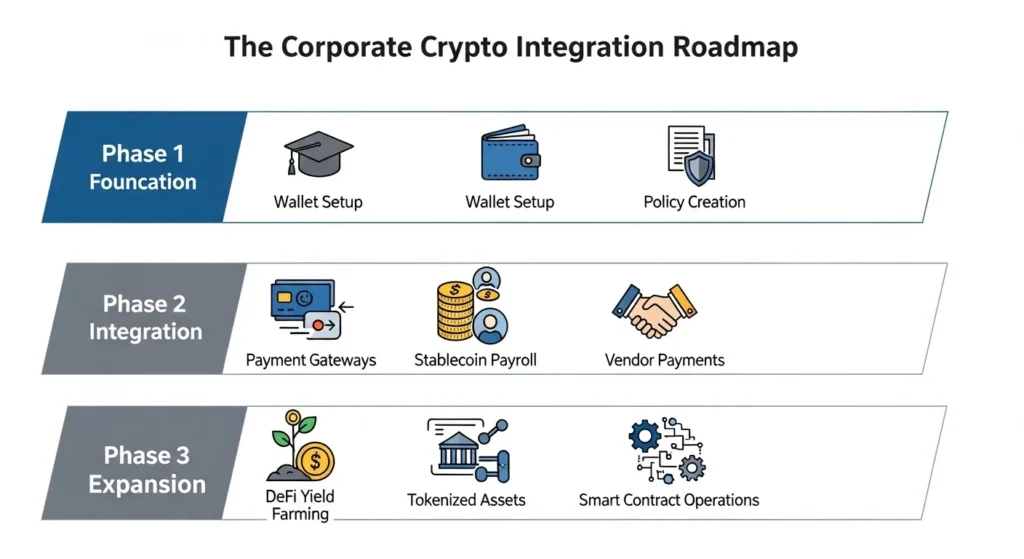

Visual Element:

The Corporate Crypto Integration Roadmap

A flowchart in corporate blue and slate grey, divided into three phases:Phase 1: Foundation

- Education (🎓)

- Wallet Setup (🔐)

- Policy Creation (📜)

Phase 2: Integration

- Payment Gateways (💳)

- Stablecoin Payroll (💰)

- Vendor Payments (🤝)

Phase 3: Expansion

- DeFi Yield Farming (📈)

- Tokenized Assets (🏢)

- Smart Contract Operations (🤖)

Why Businesses Are Integrating Crypto Now

“Why fix what isn’t broken?”

A fair question—until you examine the hidden costs of the legacy system.

1. Streamlining Cross-Border Payments

Traditional wire transfers are slow, opaque, and expensive—often taking 3–5 days and costing 3–5% in fees.

Crypto solves this instantly:

- Stablecoin transactions settle in seconds, 24/7

- No intermediary banks = lower fees

- Full transaction transparency

By integrating crypto payment gateways, businesses bypass the correspondent banking maze entirely.

2. Smart Contract Automation

Forget manual invoicing and payment delays. Smart contracts—self-executing agreements coded on blockchain—automate transactions based on real-world triggers.

Example: A logistics company releases payment to a carrier the moment a shipment is GPS-verified on-chain.

Result: Faster cash flow, fewer disputes, zero paperwork.

This is fintech innovation at its most practical: removing human error from transactional logic.

3. Tokenization of Real-World Assets (RWA)

Imagine turning a $10M commercial building into a liquid, tradable asset.

Through Security Token Offerings (STOs), businesses can:

- Fractionalize ownership of real estate, art, or IP

- Raise global capital without bank loans or IPOs

- Unlock liquidity in traditionally illiquid markets

This isn’t speculation—it’s a new economic operating system.

Navigating Regulation, Risk, and Compliance

Adoption isn’t without hurdles. Regulation remains the biggest challenge—and, paradoxically, the biggest stabilizer.

The Compliance Tightrope

- KYC/AML requirements are now standard for legitimate crypto operations

- Anonymous transactions are fading; on-chain compliance layers (like TRM Labs or Chainalysis) help screen addresses

- Interacting with DeFi? You must ensure counterparties aren’t sanctioned

Bottom line: Compliance isn’t optional—it’s your license to operate.

Managing Market Volatility

Yes, Bitcoin can swing 10% in a day. But you don’t have to expose your treasury to that risk.

Solution: Use stablecoins (e.g., USDC, USDT) for operational liquidity.

- Pegged 1:1 to the USD

- Enable blockchain speed without price risk

- Ideal for payroll, vendor payments, and working capital

A smart strategy blends volatile assets (for long-term reserves) with stablecoins (for daily operations).

Actionable Guide: Implementing a Crypto Strategy

Ready to move from theory to action? Follow this phased framework:

Step 1: Education & Policy Formation

- Train leadership on corporate treasury strategies involving digital assets

- Draft a clear policy covering:

- Allocation limits (start with 1–2% of reserves)

- Key custody protocols

- Tax and accounting procedures

Step 2: Secure Custody Solutions

- Never use consumer wallets for corporate funds

- Choose institutional custodians (e.g., Coinbase Prime, Anchorage Digital)

- For self-custody: multi-sig hardware wallets with distributed key management

Step 3: Integrate a Payment Gateway

- Use processors like BitPay or CoinGate

- Option to auto-convert crypto to fiat instantly—eliminating volatility exposure

- Offer customers payment flexibility without balance sheet risk

Step 4: Pilot Stablecoin Operations

- Start with vendor payments or international contractors

- Let your finance team learn wallet management, gas fees, and reconciliation in a low-risk environment

Expert Opinion: Closing the “Utility Gap”

Here’s what most consultants won’t tell you: most businesses are doing crypto wrong.

They treat it like a lottery ticket—buying Bitcoin hoping it moonshots, then panic-selling on dips. That’s speculation, not strategy.

The real value isn’t in the token’s price—it’s in the network’s utility.

Ask yourself:

- If you’re in logistics, why not settle freight charges via peer-to-peer blockchain?

- If you’re in legal services, why not automate escrow with smart contracts?

- If you’re in manufacturing, why not tokenize supply chain inventory for real-time financing?

The winners of the next decade won’t be those who held the most Bitcoin—they’ll be those who slashed overhead by 30% using blockchain.

For individuals: “HODL.”

For businesses: “Build and Utilize.”

FAQ: Common Business Crypto Questions

Q: Is it legal for my business to accept cryptocurrency?

A: Yes—in the U.S., EU, UK, and most developed markets. However, every transaction is a taxable event. Use crypto-native accounting software (e.g., TokenTax, Koinly) to track cost basis.

Q: How do we handle Bitcoin’s volatility on our balance sheet?

A: Treat Bitcoin as a long-term reserve asset (like gold). Use stablecoins for operational cash flow to avoid daily swings.

Q: What’s the difference between a coin and a token?

A:

- Coin (e.g., Bitcoin, Litecoin): Has its own blockchain; functions as money.

- Token (e.g., USDC, UNI): Built on existing blockchains (like Ethereum); represents utility, equity, or real-world assets.

Q: Will my bank shut down my account for using crypto?

A: Unlikely—if you use regulated exchanges and report transactions properly. Still, notify your bank in advance to avoid account flags.

Conclusion: Future-Proofing Your Business

The cryptocurrency business perspective isn’t about digital money—it’s about reimagining how value moves.

From Bitcoin ETFs legitimizing digital assets to RWA tokenization unlocking trillions in dormant value, the infrastructure is here.

But the window for early-mover advantage is narrowing. As global regulations solidify, the cost and complexity of entry will rise.

By starting now—with education, secure custody, and practical use cases—you do more than modernize your operations.

You future-proof your enterprise.

The greatest risk isn’t adopting crypto too soon.

It’s waiting until it’s your only option.