Understanding MDRN Capital fees is the crucial first step for anyone considering a transition to a fully virtual financial planning experience. In a world where digital convenience is king, the financial services industry is finally catching up—and firms like MDRN Capital, led by Aaron Cirksena, are at the forefront of this revolution.

If you’re approaching retirement or looking to optimize your wealth without the hassle of quarterly boardroom meetings, you’ve likely encountered their marketing. But the key question remains:

Does the cost structure of a remote-first firm align with the value they deliver?

As someone who has analyzed wealth management trends for over 15 years, I’ve witnessed the shift from stuffy, mahogany-desked offices to streamlined, online financial planning services. The allure is obvious: lower overhead for the firm often translates to better fee structures for clients. Yet transparency is non-negotiable.

In this comprehensive guide, we’ll:

- Dissect the costs associated with MDRN Capital

- Analyze the value of their virtual financial model

- Help you decide if this modern approach suits your financial future

The Evolution of Remote Financial Planning

Before diving into pricing, it’s essential to understand why firms like MDRN Capital exist.

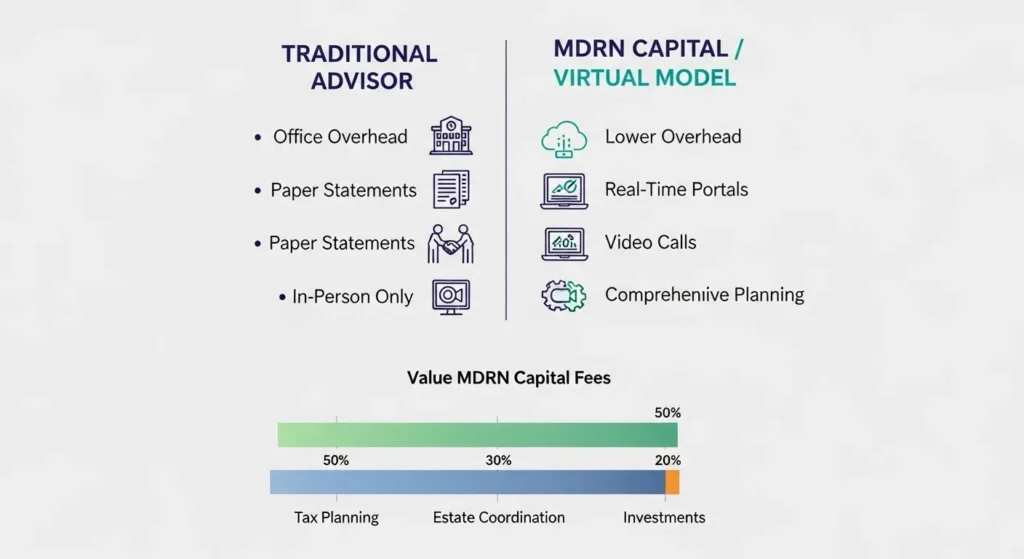

The traditional financial advisory model is expensive. It relies on:

- Prime real estate leases

- Large administrative teams

- Physical infrastructure

These costs are passed directly to clients, often buried in opaque fee structures.

Enter the remote financial planner—a disruptor that flips this model on its head. By going fully virtual, firms can:

- Reallocate funds from rent to better technology

- Invest in secure client portals

- Hire top-tier advisors without geographic constraints

This efficiency forms the backbone of the modern value proposition.

When you choose digital wealth management, you’re not just paying for investment advice—you’re paying for a technology-enabled ecosystem designed to simplify your financial life.

However, skepticism is healthy. Just because a firm saves on rent doesn’t mean you benefit—unless they pass those savings on through lower fees or enhanced service.

The answer lies in the fiduciary standard. A fiduciary advisor—whether in person or on-screen—is legally required to act in your best interest. MDRN Capital operates under this standard, delivering high-touch service without physical touchpoints.

Breaking Down MDRN Capital Fees

When we discuss MDRN Capital fees, we’re talking about a transparent, fee-only structure—a welcome shift from the commission-based models of the past.

While exact pricing varies based on asset size and complexity, most comprehensive virtual advisors (including MDRN Capital) use one of two models:

The AUM vs. Flat Fee Debate

- Assets Under Management (AUM) Model:

You pay a percentage (typically 0.5%–1.25% annually) of the assets the firm manages.

✅ Aligns incentives: If your portfolio grows, so does their fee—and vice versa. - Flat Retainer Model:

A set monthly or annual fee regardless of portfolio size.

✅ Predictable costs, ideal for clients with complex financial lives but modest investable assets.

MDRN Capital primarily serves pre-retirees and retirees, so their fee usually covers a holistic suite of services—not just investment selection.

What Are You Actually Paying For?

It’s a mistake to view these fees as merely the cost of managing mutual funds. With robo-advisors commoditizing basic investing, the real value lies in human-guided, strategic planning—delivered virtually.

Your MDRN Capital fee typically includes:

- Comprehensive Retirement Planning

- Detailed cash flow projections

- Sustainable withdrawal strategies

- “Work Optional” lifestyle engineering

- Tax Optimization

- Roth conversion planning

- Tax-loss harvesting

- Strategic asset location

- Investment Portfolio Management

- Personalized risk profiling

- Ongoing rebalancing

- Behavioral coaching during market volatility

- Estate Planning Coordination

- Collaboration with your estate attorney

- Beneficiary review and trust alignment

The true test of any virtual firm: Are they using their operational savings to lower your costs—or to enhance service quality and frequency?

Based on industry benchmarks, a well-run virtual firm like MDRN Capital should offer either lower fees or significantly more value than traditional advisors.

The Technology Advantage: Is It Worth the Price?

A hidden but critical component of MDRN Capital fees is access to high-end personal finance technology.

In a traditional model, you might receive:

- A paper statement every quarter

- One annual review meeting

With MDRN Capital’s virtual model, you get:

- Real-time dashboard access via a secure client portal

- Aggregated financial data (bank accounts, investments, real estate, liabilities) in one place

- Screen-sharing planning sessions where you can walk through retirement scenarios live

This isn’t just convenience—it’s collaborative financial clarity. And because decisions can be implemented instantly through integrated custodians (like Schwab or Fidelity), you gain agility that traditional firms simply can’t match.

Actionable Guide: How to Evaluate if MDRN Capital Is Right for You

Deciding whether to pay MDRN Capital fees is a significant commitment. Follow this step-by-step framework:

Step 1: Audit Your Current Fees

- Pull your latest statement or Form ADV

- Add up all costs: advisory fees + fund expense ratios + trading fees

- If you’re paying over 1.5% annually without receiving tax, estate, or retirement planning—you’re likely overpaying

Step 2: Assess Your Digital Comfort Level

- Are you comfortable managing your financial future via Zoom?

- If you need in-person handshakes to feel secure, no fee savings will compensate for that discomfort

Step 3: Evaluate the “Work Optional” Philosophy

- MDRN Capital focuses on lifestyle-driven retirement, not market-beating returns

- If your goal is aggressive growth (e.g., outperforming the S&P 500), a hedge fund or growth-focused advisor may be better

- If you want engineered financial security, their model is likely a strong fit

Step 4: Request a Transparent Fee Breakdown

During your consultation, ask:

“For a portfolio of my size, what is the total annual fee in dollars, and what specific deliverables will I receive in the first 12 months?”

Compare this to local fee-only advisors—dollars for deliverables, not percentages alone.

My Expert Opinion

After reviewing hundreds of advisory firms over 15 years, here’s my “hot take” on MDRN Capital fees and Aaron Cirksena’s model:

The industry is terrified of this—and they should be.

For decades, advisors justified high fees with myths of “exclusive access” or “secret strategies.” The internet shattered that illusion. Today, real value comes from behavioral coaching, tax strategy, and retirement engineering—not stock picks.

In 2024, paying a premium for a physical office is a waste of money—if the virtual alternative delivers equal or better service.

The MDRN Capital fees are justified only if they use their digital efficiency to:

- Increase communication frequency (e.g., monthly check-ins vs. annual reviews)

- Provide ongoing education (webinars, planning tools)

- Offer a superior client experience via technology

If you’re paying ~1% and getting more touchpoints, deeper planning, and real-time access, you’re getting a bargain compared to the traditional advisor who charges 1% to sell you an annuity and calls once a year.

The fully virtual model is the future—but only for firms that use efficiency to deepen relationships, not just boost profits.

Frequently Asked Questions

Q: Are MDRN Capital fees tax-deductible?

A: Under current U.S. tax law (post-TCJA), advisory fees paid from taxable accounts are not deductible as itemized deductions. However, fees paid from a traditional IRA are effectively pre-tax, offering an indirect tax advantage.

Q: How do their fees compare to robo-advisors?

A: Robo-advisors charge 0.25%–0.40% but offer minimal human guidance. MDRN Capital provides comprehensive human-led planning, so fees are higher (likely ~1%), reflecting the value of Certified Financial Planner (CFP®) expertise.

Q: Is my money safe with a remote firm?

A: Yes. MDRN Capital uses third-party custodians (e.g., Schwab, Fidelity) to hold your assets. They never take possession of your funds—ensuring safety regardless of physical location.

Q: Can I cancel if I’m not satisfied?

A: Most fee-only fiduciary firms, including virtual advisors like MDRN Capital, operate on quarterly or monthly billing cycles with no long-term contracts. Always confirm this during onboarding—flexibility is a hallmark of modern virtual advising.

Conclusion

Evaluating MDRN Capital fees requires looking beyond a simple percentage on a statement. You’re assessing a trade-off:

- Giving up the traditional office

- Gaining a streamlined, responsive, technology-driven partnership

For the modern retiree who values freedom, clarity, and efficiency, Aaron Cirksena’s “Work Optional” philosophy represents a logical evolution of wealth management.

If you’re ready to embrace virtual tools and partner with an advisor focused on lifestyle security over market hype, the cost is likely a worthy investment in peace of mind.

But always:

- Compare hard costs

- Assess service depth

- Ensure trust in the human on the other side of the screen

The future of finance is remote—but the principles of trust, transparency, and value remain timeless.